THE WEEK ON WALL STREET

Stocks ended last week mixed. A widely anticipated Federal Reserve decision on interest rates and a rotation into non-tech areas helped push the Dow Industrials higher, while the broader market and technology stocks lagged behind.

The S&P 500 Index declined 0.63 percent, while the Nasdaq Composite Index fell 1.62 percent. Meanwhile, the Dow Jones Industrial Average advanced 1.05 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 0.89 percent.

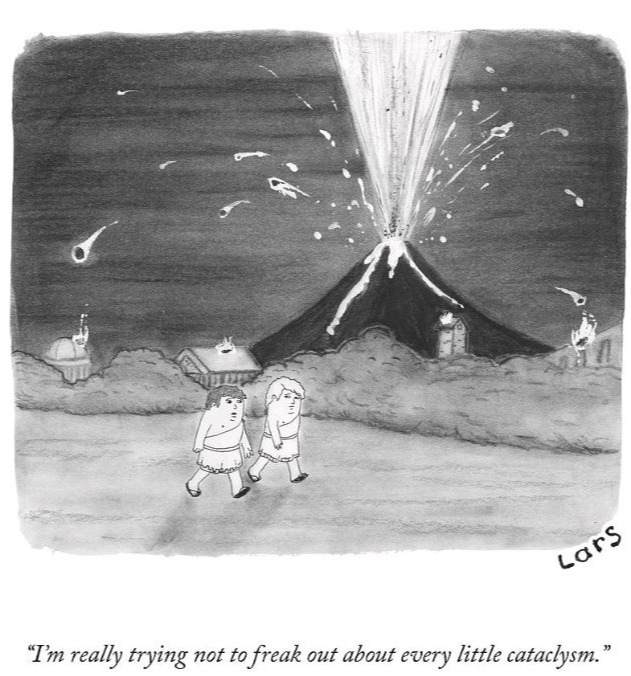

FACT OF THE WEEK

On December 16, 1707, Mount Fuji erupts, raining 28 billion cubic feet of ash on fields up to 60 miles away and causing widespread starvation. Fuji remains an active volcano.

MARKET MINUTE

Market Rotation After Fed Decision

Stocks stayed in a fairly tight trading range over the first half of the week. Tech remained a strong spot on Monday despite slight to modest declines in all three major averages.

By Tuesday’s close, all three major averages were slightly to modestly lower week-to-date as the Fed’s last interest-rate-setting meeting of the year approached.

Then, on Wednesday morning, stocks rose ahead of the Fed’s announcement that it was lowering rates by a quarter percentage point—a widely expected move. By the close, all three major averages ended in the green.

A market rotation theme dominated the rest of the week, as investors shifted into cyclical areas of the economy that are likely to benefit from an economic rebound. The Nasdaq ended Thursday’s session lower, while the S&P and Dow Industrials hit fresh record closes. The Russell 2000 Index of small-cap stocks also notched new closing highs.

The rotation into value stocks continued on Friday, with some AI names coming under pressure. The financial, healthcare, and industrial sectors were among the groups that seemed to benefit from the rotation.

No Surprise, Just Tea Leaves

Last week’s rate decision from the Federal Reserve was no big surprise. Speculators had already priced in this outcome weeks ago.

Now for reading the tea leaves: First, Fed Chair Powell stated in his press conference on Wednesday that they have ruled out a rate hike for the foreseeable future, but also noted that it would be a higher bar for further rate reductions. Another point was the degree of dissent: the vote was 9-3.

Then on Friday, voting members who dissented expressed views on inflation and jobs, and which risk was the more important one to address through monetary policy.

FINANCIAL STRATEGY OF THE WEEK

As we approach the end of the year, it’s the perfect time to reflect on the accomplishments of the past year and focus on the opportunities that lie ahead. It’s also a great time to review your financial plan to ensure it aligns with your goals. Here are some year-end planning tips that can help set you up for success:

Define your personal budget. You can easily set next year's budget when you understand the past year's cash flow and expenses. Creating a budget can help you better manage future financial commitments, save for retirement, and work toward your goals.

Assess your tax situation. Neglecting to assess your tax situation at the end of the year can lead to financial consequences and missed opportunities at tax time. Planning for your taxes at the end of the year can help you save significant money in the long run. Be proactive in your tax planning by considering capital gains, deductions, losses, and tax credits.

Increase your retirement contributions. Increasing your contribution towards your retirement savings accounts is a strategic year-end planning tip. Max out your 401(k), IRA, and other tax-advantaged retirement savings vehicles to take advantage of reducing your taxable income by the end of the year and save more now. The compounding effect of tax savings over time can be substantial.

Evaluate your investment strategies. Review your investment portfolio at year-end to gauge its performance and take corrective actions. Whether you need to rebalance your portfolio or sell underperforming assets, a thorough yearly analysis can help determine if your portfolio aligns with your risk, timeline, and goals.

Review your employer-sponsored benefits. Review your flexible spending (FSA) and health savings accounts (HSA) before the year ends. If you don't use your FSA benefits, you may risk losing unspent funds at the end of the year. If you need more clarification, check with your HR department about your FSA and HSA or which medical expenses are eligible for reimbursement.

Consider charitable giving. Whether for philanthropic purposes or a tax deduction, end-of-year charitable giving is a staple for many throughout their planning process. If you plan to donate, consider doing so before the year ends to claim deductions on this year's tax return when you file in the New Year. Remember to track your donations carefully and keep records for tax filing.

Update your estate plan. Set aside time to review your estate planning documents before year-end. These documents may include your will, power of attorney, and healthcare directive. Ensure these documents reflect your wishes and that your beneficiary designations on your retirement accounts, life insurance policies, and other assets are current.

The end of the year can bring a fresh perspective to financial planning. If you have any questions or you’re considering making some changes, let’s connect. We would be happy to help you feel more confident with your finances going into new year.